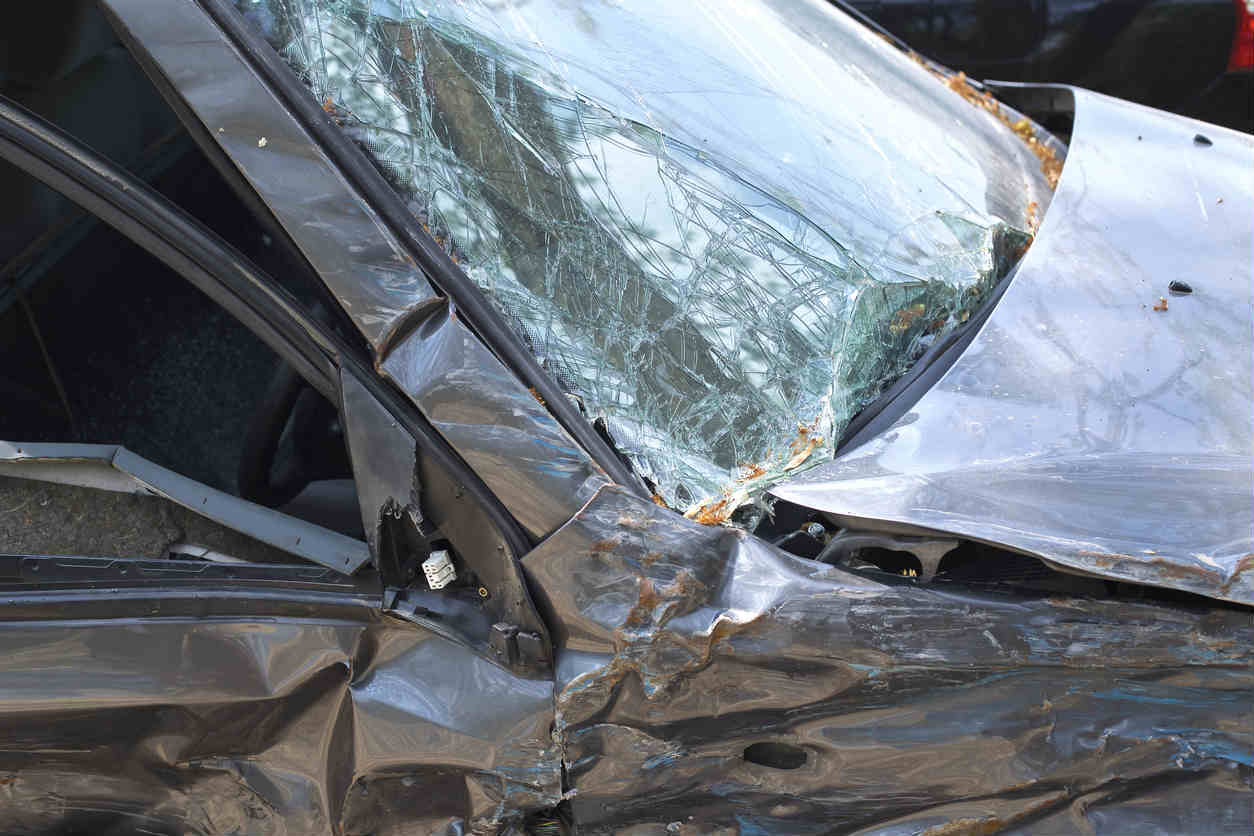

If you are in a car accident where your car is totaled, it is in your best interests to speak with an attorney to help you get the money you deserve.

You pay for auto insurance so that if something happens, there is someone else to take car of the cost. It is very disheartening to find that if your car is no longer drivable, you may have to pay for it, even if it isn’t your fault.

When you buy a car and finance it, you will end up paying more than the car originally cost due to financing charges. If you take out a high-interest loan, or a long-term loan, there might be a point where you will owe more on the car than the car is worth. Being upside down means that you owe more on the loan to pay it off then it is worth on the market.

When you get into a car accident, and your car needs to be totaled, the insurance company doesn’t care about how much you owe on it. Their obligation is to replace a “like” car. That means that if you owe more than the car is worth in market value, you are going to be responsible for paying the difference between what it is worth and what it will take to replace it.

How the car is valued when totaled

When your car is totaled in an accident, you will still owe the loan amount, whatever is remaining. An insurance adjuster will take the specifics of the car like make, model, and year, and find what it would cost to replace it in the current market. That isn’t always going to match what you actually owe the lender for the car. The condition is also taken into account and determined according to what it was in prior to the accident, not after.

Due to something called depreciation, the value of your car will decrease after you drive it off the lot. The age and the mileage of the car will make it less valuable regardless of how much you still owe on it. Other things like the maintenance record, the parts replacements and repairs, and other specifics about your vehicle can all be used to determine the replacement value.

If you had a major accident in the past, it will generally affect the price you will be entitled to recover. The insurance company will conduct a thorough investigation of your vehicle history and make sure that they come up with a realistic figure of how much it will cost to replace the vehicle.

Offer/counteroffers

When an insurance company offers you a dollar amount to replace your totaled vehicle, it is possible for you to counter offer. Don’t just assume that the dollar amount they set, is set in stone. If you have proof that their price is low, you can counter the offer. You will likely need some proof to substantiate your counter offer, and the process might go back and forth several times before you reach an agreement.

St. Louis Car Accident Lawyers

If you are in a car accident where your car is totaled, it is in your best interests to speak with a St. Louis car accident lawyer to help you get the money you deserve. The insurance company does not have your best interests at heart. It is important to have someone in your corner, looking out for your best interests. At The Hoffmann Law Firm, L.L.C. we can help! Give us a call 24/7 at (314) 361-4242 for a free case evaluation.